If you’ve found yourself deep in the fine print of a credit card agreement wondering what exactly it all means, you’re not alone. Credit card interest can be incredibly confusing, and even a single card may have multiple interest rates.

How does credit card interest work anyway? Knowing the answer to that question can help you save money.

Read on to learn about the key differences between credit and debit cards, how to get the best credit card interest rate, and what you’ll need to know to understand how much interest you’re being charged on your purchases.

Credit vs. Debit Cards: What’s the Difference?

Both credit cards and debit cards allow you to pay just about anywhere without using cash. It’s hard to tell the actual cards apart: both have chips, magnetic strips, and lengthy numbers.

But looks aren’t everything. These cards have very different functions, and it’s essential to know about these differences.

Debit cards

Debit cards are connected to a checking or savings account, and money is withdrawn from the account at the point of purchase. Essentially, they’re like writing a check that is immediately cashed. Debit cards can also be used at ATMs to withdraw cash straight from your account.

Debit cards don’t allow you to overspend; if you try to make a purchase and don’t have enough money in your account, your purchase will be declined (unless you have overdraft protection).

Credit cards

On the other hand, credit cards are a form of credit that allows you to charge purchases and pay for them later. If you repay all the charges by the statement due date, you won’t be charged for using the credit card. But if you carry a balance, you will pay interest on that amount.

Credit cards can be a tool to help you pay for large purchases you can’t cover in cash or a means of earning cash back rewards on purchases you were going to make anyway. However, because credit cards allow you to spend money you may not have, it’s important to use them responsibly to avoid going into debt.

There are several types of credit cards with different terms and conditions. The right credit card for you will depend on various factors, from your income to your credit needs.

Credit Card Interest: Key Terms and Definitions

To understand how credit card interest works, it helps to understand the language credit card companies use when explaining their rates and terms.

Interest rate

Interest rate expresses how much you’ll be charged in interest on any charges you don’t repay in full by the due date. The term can sometimes be used interchangeably with APR.

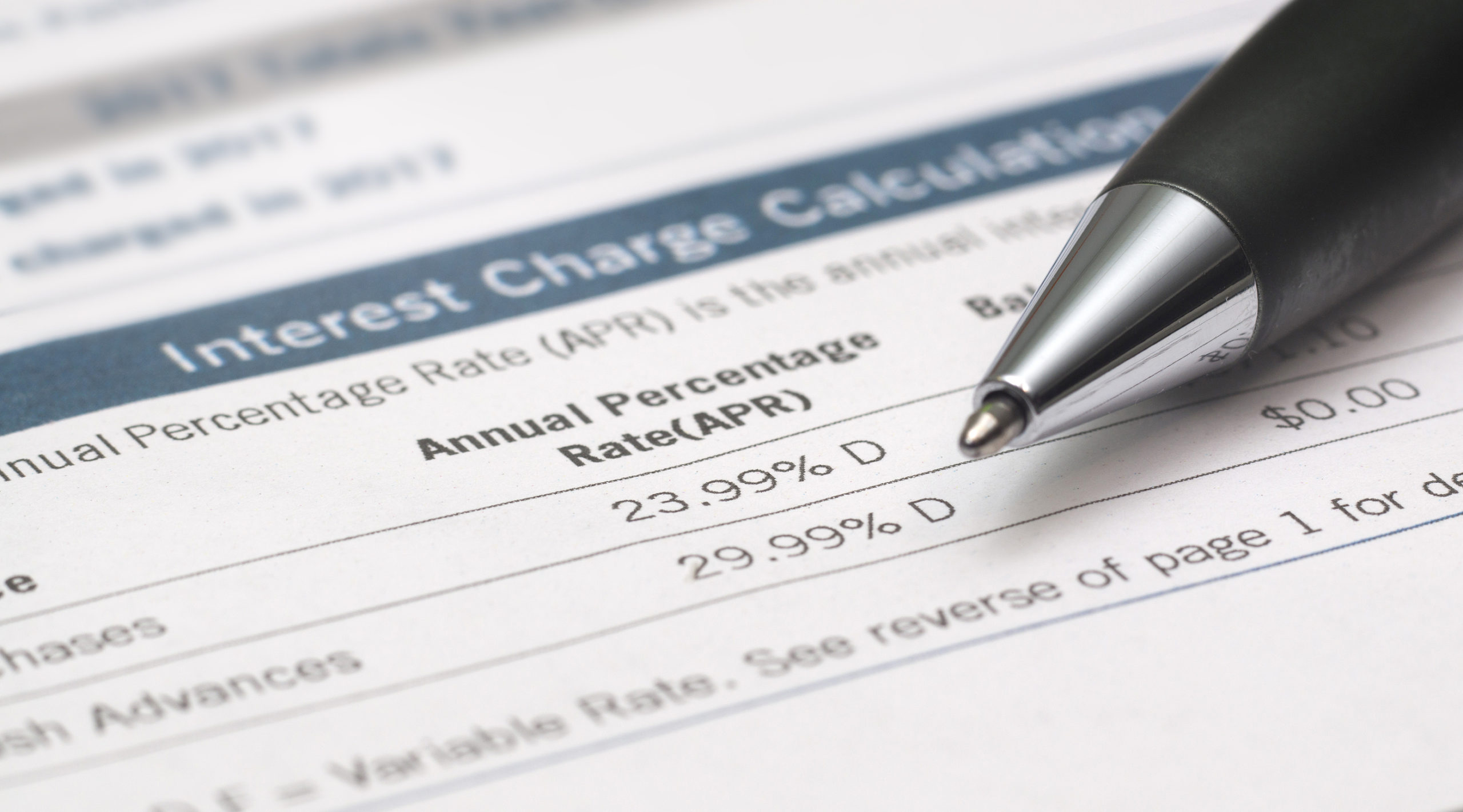

APR

The APR, or annual percentage rate, indicates how much your credit will cost over a year. It includes both the interest rate and any fees or other charges you’re assessed.

Read More: Guide to Credit Card APR

Statement balance/period

Your statement balance is how much you’ve charged within the statement period. The statement period is generally one month, and you can often choose your statement period dates and due date when you apply for a credit card.

To avoid paying interest on your charges, you’ll need to pay the entire statement balance by the due date. (This means that you don’t need to pay the card down to $0 by the due date as long as the remaining statement balance is $0.)

Prime rate

The prime rate is an interest rate that banks use for their best customers; it goes up or down depending on the cost of credit and policies issued by the U.S. Federal Reserve.

Most credit card interest rates are expressed as the prime rate plus a percentage (e.g., “prime rate plus two percent”). But, this doesn’t guarantee you’ll get the exact rate advertised. The rate you get will depend on your credit score.

Finding the Best Credit Card Interest Rate

The average APR for all credit cards is 15.56% to 22.87%. This means that carrying a balance on one or more credit cards can be an expensive prospect. However, using a credit card calculator can give you a sense of how long it will take to pay off your balance.

It’s important to find a good credit card interest rate and avoid carrying a balance if possible. If you do end up with a credit card balance that you can’t repay in full before the next statement period, prioritize this debt to pay it off as quickly as you can.

Ultimately, your credit card interest rate will depend on your credit score and overall credit profile. The higher your credit score, the better your rate—and if you have a high income and low overall credit utilization ratio, you’re more likely to qualify for the most favorable interest rates (including 0 percent APR promotions).

How Does Credit Card Interest Work: Next Steps

At Bowater Credit Union, we can help you sort out all the details about how credit card interest works.

And, if you’re still deciding between a debit card and credit card, or if you want to learn more about credit cards before applying for one, click below. There, we explain the key differences between these two types of cards, as well as the advantages and disadvantages of each.

Is a Credit or Debit Card Safer for Online Shopping

Ready To Apply?

We offer several different credit cards to meet your needs, whether you are looking for a card that offers rewards on everyday purchases, or a classic card with a low fixed rate.